How to know it’s a smart time to buy a home: 5 signs to keep an eye on

While we know home prices historically rise over time - suggesting the sooner you purchase a home the better - the suggestion that “the best time to buy is NOW!” isn’t helpful to a someone who’s trying to navigate the nuances of the market. (And if you’re anything like me, it’s actually hive inducing, as I’m allergic to sales-y propaganda.)

The most important thing to consider when purchasing a home is your own personal timing and life situation, but if you’re looking to align your personal timing with the market’s, here are the 5 signs that indicate it’s a smart time to make a home purchase.

1. Home Prices Have Softened or Stabilized

When median home prices dip year-over-year or remain flat after a period of growth, it suggests buyers have more leverage. Seasonal dips (often late fall/winter) can also create opportunities to snag a better price.

What’s happening in Seattle? - The market is less uniformly overheated than it was the last 5 years, and that gives buyers opportunities to find deals if they look in the right neighborhoods and price ranges. There are several areas/neighborhoods around Puget Sound where home prices are stabilizing or even easing. This means there's potential to pick off homes at more favorable price trends, but location, condition, and timing still matter a lot, as some snapshots of the market show median home price increasing year over year.

2. More Inventory (Higher Months of Supply)

More inventory usually means less competition and more negotiation room for buyers. If supply rises above what’s considered a “balanced market”, sellers are forced to compete more for buyers, which can lead to price reductions or seller concessions (covering closing costs, rate buy-downs, etc.).

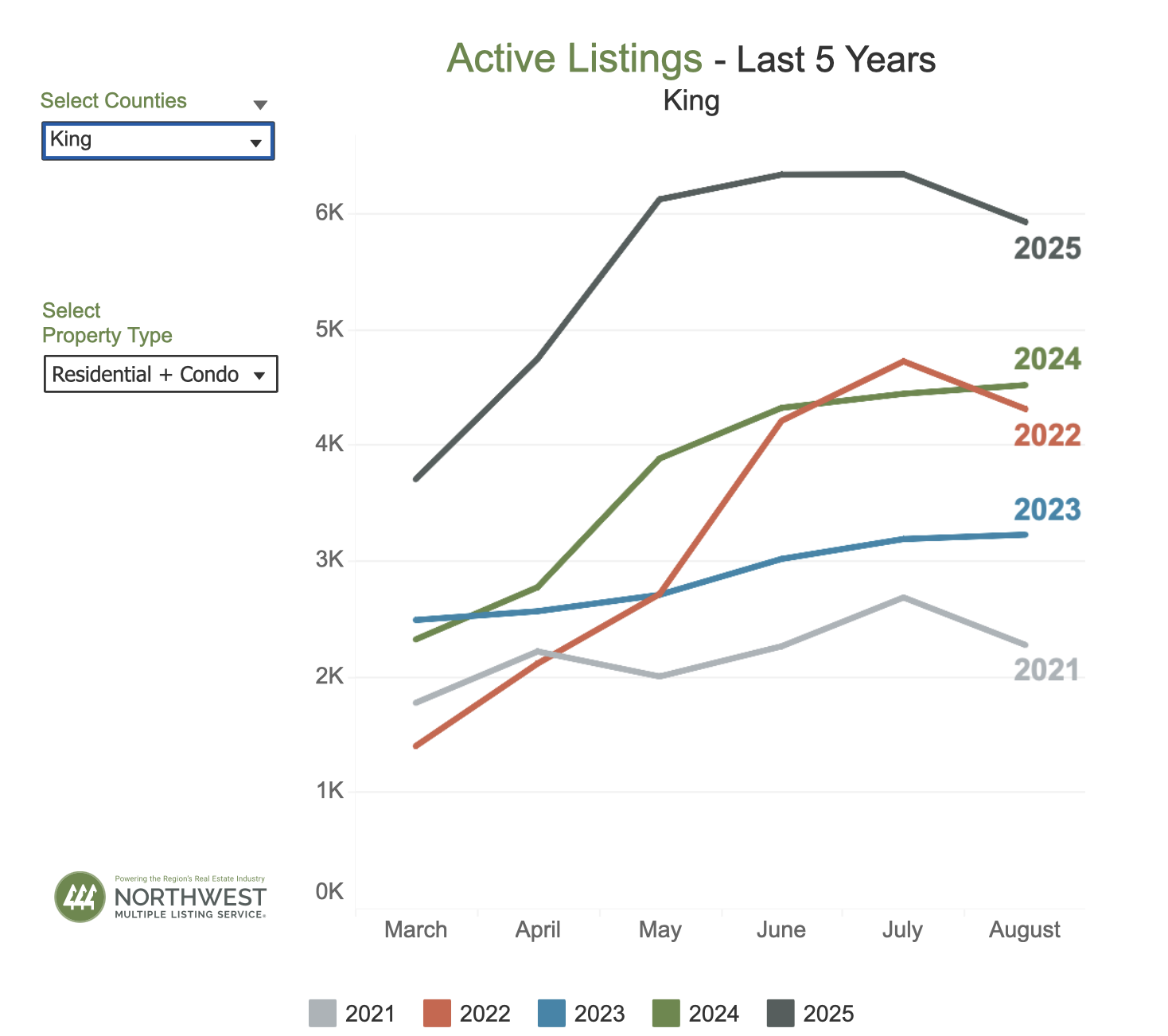

What’s happening in Seattle? - Inventory is increasing in many parts of Seattle and surrounding areas, with a 31% year-over-year increase in homes for sale in King County from the end of August 2024 to now according to the NWMLS.

3. Lower Buyer Competition, Seller Concessions & Incentives

Fewer bidding wars and homes sitting on the market longer (higher average days on market) signal reduced competition. This gives buyers more room to negotiate instead of feeling pressured to waive contingencies. When sellers start offering perks like rate buy-downs, closing cost credits, or upgrades, it’s a sign buyers have regained negotiating power.

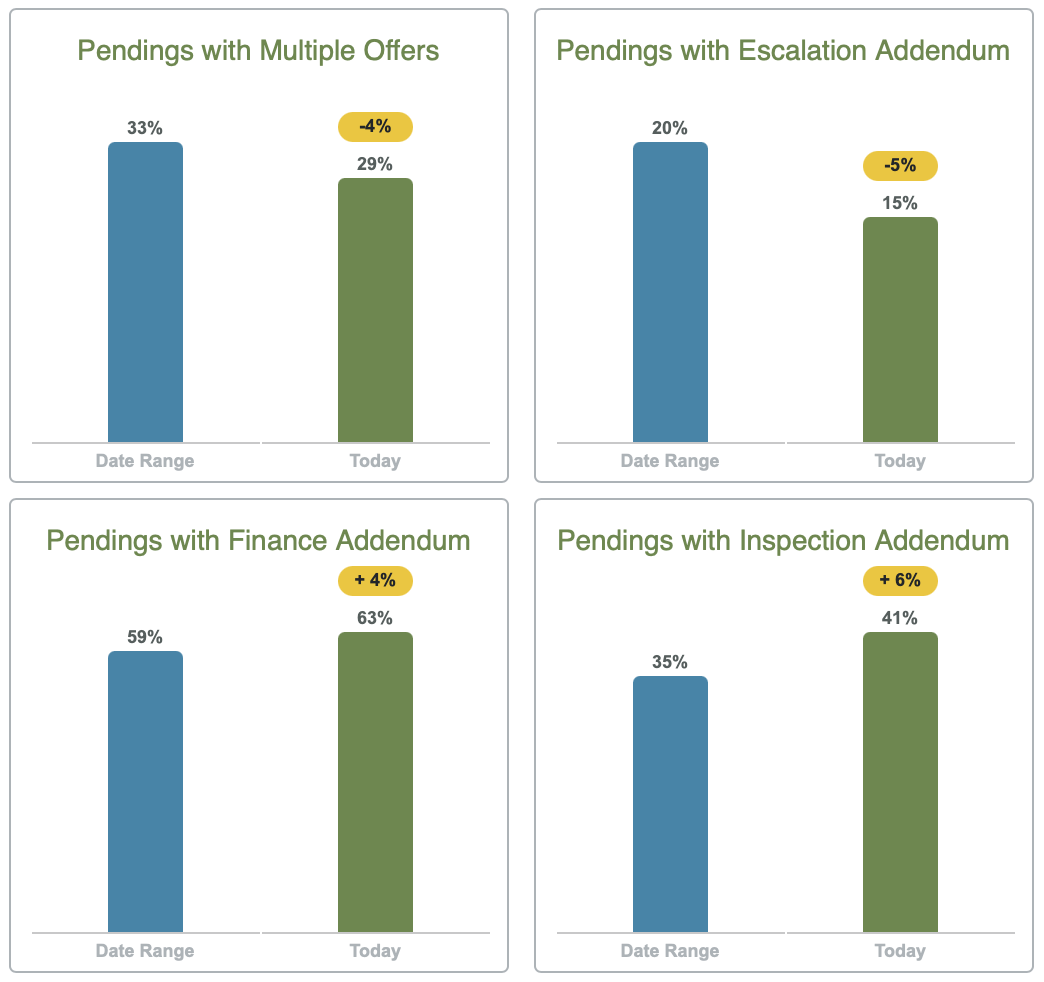

What’s happening in Seattle? - While competition is still heavily dependent on a home’s location and style/condition, Seattle is seeing fewer escalations and multiple offers overall with more offers containing protections like financing and inspection contingencies. Historically, the late fall and winter months bring fewer buyers to the market, meaning sellers may be more motivated to make a deal. Spring and summer often see higher competition and higher prices.

Courtesy of the NWMLS. Data reflects all Seattle Residential homes - for each metric, “Today” includes all listings that are currently in a Pending status as of 9/19/2025, and “Date Range” includes all listings with pending date from Sept ‘24 to Sept ‘25.

4. Interest Rate Trends

A drop in mortgage interest rates (or signals from the Federal Reserve about potential cuts) often precedes a surge in demand. The best “sweet spot” is when prices are still soft but rates have begun trending down, before the wider market jumps back in. The window right before a decent, sustained rate cut can be a smart time to buy, where you lock in a home now and could refinance later at lower rates if/when they arrive.

What’s happening now? - Interest rates have started trending downwards, with 30-year fixed rates sliding down to ~6.2%, due to a Fed easing cycle (already started in Sept 2025), which tends to lower mortgage rates over time and bring buyers back into the market. This often leads to higher competition and higher prices later. View today’s mortgage rates here.

Courtesy of Mortgage News Daily. 30 year Fixed Mortgage Rates Sept ‘23-Sept ‘25 (blue - Mortgage News Daily, grey - MBA, orange - Freddie Mac)

5. Economic Indicators

Job growth and local economic stability are strong signs for long-term housing value. If your local economy is growing but the housing market is cooling temporarily, that’s often a good buy-in window.

What’s happening in Seattle? - With ~18,900 people moving to Seattle annually, the city still has strong economy and housing demand remains firm, especially in neighborhoods with good amenities, commute, etc.

Bottom line: Is now a good time to buy in Seattle?

Yes, for many buyers, this is a more favorable environment than recent years’ peak competition. Some of the “good time” signs are aligning:

Prices are flattened or slightly down in some slices of the market.

Inventory is increasing, giving more choices.

Buyer competition has cooled somewhat.

Interest rates have eased just enough to help.

Seller concessions are becoming more common.

What this means for you as a Seattle buyer…

If you find a well-priced, well-located home you love - move. With inventory rising, homes that are priced right still get snapped up. Being prepared (loan pre-approval, inspection plan, local comps) matters.

If you’re rate-sensitive, remember you can refinance. If rates come down after you buy, you can almost always refinance later (be sure to chat with your lender about your options here). That’s why many buyers prefer to secure the right property now rather than wait and face a hotter market.

Negotiate for protections. include inspection contingencies, appraisal gap language tailored to your strategy, and consider asking for seller credits where appropriate. Slower markets mean more room to negotiate.

Watch neighborhood-level stats, not just county medians. Zip-code microtrends can diverge a lot inside King County. Dig into comps, days-on-market, and active vs. pending listing data for the exact area you want.

Have a 2–5 year plan. If you plan to live in the home for multiple years, short-term rate/price noise matters less. If you’re flipping or speculating, the timing calculus is very different.

If you find the right property at the right price, being ready to buy now (and refinance later if rates fall) is a smart, practical strategy. Use local, zip-level data and a solid agent (hi! 👋🏼) to make it work. You got this!